How Does the Government's 'Housing for All' Plan Impact Buyers?

Sep 03, 2021

The Irish Government recently announced its "Housing for All" plan to bring about changes to the housing market in Ireland. While there is ongoing debate on whether the plan will go far enough, this post will lay out in simple terms how it may impact those looking to purchase a home in the near and long term.

New First Time Buyer Incentive - First Home

Starting in early 2022, the government will introduce a scheme known as First Home. The scheme will provide support to those on moderate incomes to allow them buy a property. First Home is a “Shared Equity” scheme, meaning that the government will assist in purchasing a home in exchange for partial ownership. The government will contribute up to 30% of the price of a new home, worth in the range of €225,000 to €450,000 depending on the area. The stake in the property owned by the State can be optionally bought back at any time by the homeowner.

While this incentive is helpful to some buyers there is concern that it will raise the price of affordable homes if the government does not meet their supply targets to match the new buyers this will bring into the market.

Cost Rental Housing

The government aims to reduce rent for many stuck in a situation where they cannot save enough to buy a home due to the high cost of rent. To help, the Housing for All plan introduces “Cost Rental” housing. These will be newly built rental homes where the cost of rent will only cover the price of building and maintaining, ie. the government will not make a profit. As such, rent for these properties should be 25% or less than market rates.

Increased Housing Supply

Increasing the housing supply is important to maintain or reduce house prices. The Housing for All scheme has set targets for Ireland to build an average of 33,000 homes per year until 2030 in an effort to bridge the current demand. Some contributing efforts to reach these goals include:

- Introduce a tax on certain vacant lands suitable for housing. Note that there are no commitments yet to introduce a tax on vacant homes themselves.

- Create a "Rural Regeneration" and an "Urban Regeneration" fund to encourage refurbishment of vacant properties.

- Reduce bulk housing purchases by investment funds through specifying the minimum number of homes in new developments that must be sold to individual buyers.

- Streamline the approval process for new developments.

Find Out More

If you would like to read through any of the 160 page plan, take a look at the publication on gov.ie.

Lively is Making it Simpler To Buy A Home in Ireland

"Life Saver!"

★★★★★

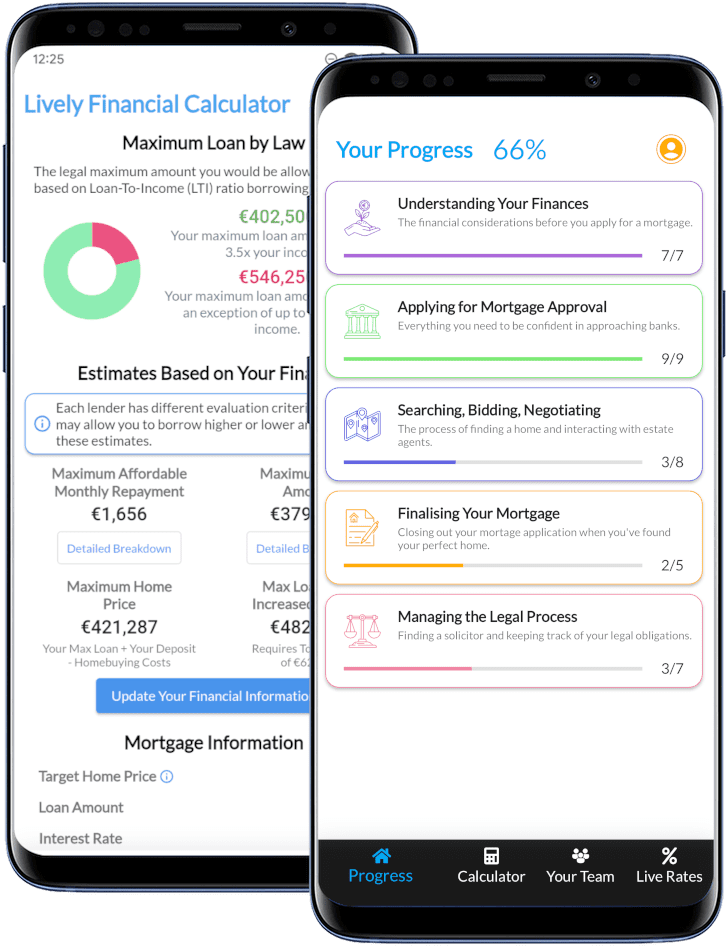

Lively was created as a passion project to help buyers through the complicated and often overwhelming process of buying a home. Download our completely free app containing the best mortgage calculator out there, a step by step guide on how to buy a home in Ireland and live interest rates!