How to Get a Mortgage Exception/Exemption in 2023

Sep 26, 2022

With interest rates and by extension monthly mortgage repayments increasing rapidly, it’s becoming more challenging for buyers to secure mortgage exceptions. Our guide will show you that, despite what many think, securing a mortgage exception doesn’t rely on a magic unknown formula and in fact there are clear steps you can follow to give yourself a great chance of getting an exception from a lender.

What is a Mortgage Exception/Exemption?

The Irish Central Bank has rules in place that limit the amount a homebuyer can borrow from a lender. For example, the Loan-To-Income (LTI) limit means that First Time Buyers cannot borrow more than 4x their pre-tax income and 3.5x for Subsequent Buyers. While not perfect, these restrictions are designed to prevent people borrowing more than they can afford to repay. An exception, sometimes called an “exemption”, is when one of these limits is increased so that a borrower can acquire a larger loan.

Different Types of Exceptions

1. Loan-To-Income (LTI) Exceptions

This kind of exception is the most common and when granted allows an applicant to borrow more than the typical borrowing limit of 3.5x/4x their pre-tax income. Those granted an LTI exception are able to borrow 4.5x of their income if their financials support it, or even up 5x with some lenders. Lenders can give these kinds of exceptions for up to 20% of the value of their mortgages.

As an example, with this kind of exception a couple earning a combined €100,000 per year would no longer be limited to a €350,000 loan and could now borrow up to €500,000.

2. Loan-To-Value (LTV) Exceptions

First time buyers in Ireland are not permitted to borrow more than 90% of the value of a home and subsequent buyers are limited to 80%. Exceptions can be granted to this rule and they are typically given to second time or subsequent buyers who aren’t able to save the required 20% deposit.

Legally lenders can allow exceptions for customers to borrow more than 90% of the value of a home though in practice these exceptions are extremely rare.

The Best Time to Apply for a Borrowing Exception

As lenders have a limited amount of exceptions they may grant each year, it’s generally better to apply for an exception at the beginning of the year because as the year progresses they will get closer to filling their allowance. However, if you’re reading this later in the year don’t let that put you off, it’s still quite possible to secure an exception!

Steps to Prepare for Your Exception Application

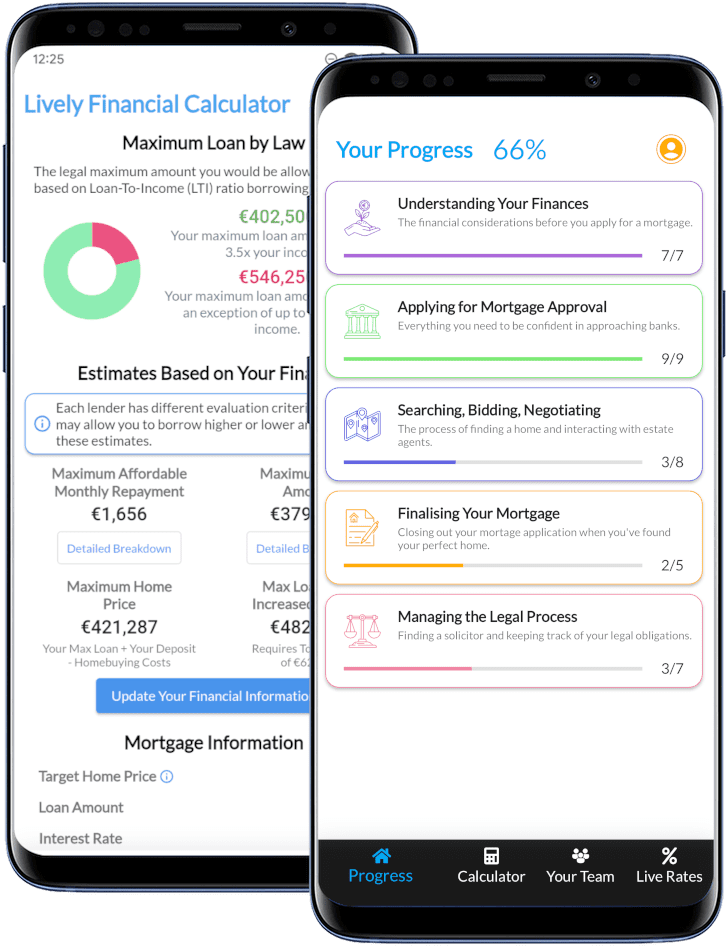

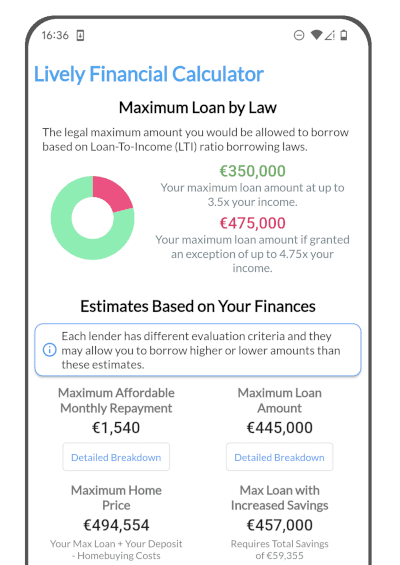

We’ll use Lively’s completely free in-app calculator to generate the example calculations here. Download it now to quickly generate your own customised insights!

1. Prove You Can Afford the Monthly Repayments

Ultimately to get an exception you’ll need to be able to clearly demonstrate that you can comfortably afford it if you are granted one.

In the following example, a couple earning a combined €100,000 per year, saving €1,100 per month, paying rent of €1,800 per month and with no children can likely afford a monthly repayment of €1,540 and could be eligible for an exception of roughly 4.45x their income.

Here are the key calculations used to arrive at the above result:

Repayment Capacity - Your Repayment Capacity is the amount of your income that you can prove may contribute to monthly mortgage repayments. Monthly rent, savings and payments on loans that will end before you purchase your home can all contribute to your Repayment Capacity.

Disposable Income - Typically lenders don’t want you to spend more than 50% of your post-tax earnings on mortgage repayments. As such, 50% of the amount that lands in your bank account every month is the upper ceiling for your max monthly repayment. This is called your Mortgage Servicing Ratio (MSR).

Net Disposable Income (NDI) - Lenders expect you to have a minimum amount to live on after your regular financial commitments, like your mortgage repayments and childcare costs. The amount left is your NDI. Lenders have different requirements here, though the average is €1,400 per month for individuals and €1,900 for joint applications after all of your commitments are accounted for.

Stress Test - Lenders will ‘Stress Test’ your maximum monthly repayment to verify you can meet your mortgage repayments in the case of interest rate increases. They ensure you can handle a 2% increase in interest rates which will decrease your max monthly repayment amount by roughly 23%.

2. Save a Suitable Deposit

You’ll need to have the savings required to afford the deposit on a property if you are granted the exception. You will need a minimum of 10% of the purchase price saved plus additional funds set aside to pay for additional home buying costs such as Stamp Duty and legal fees.

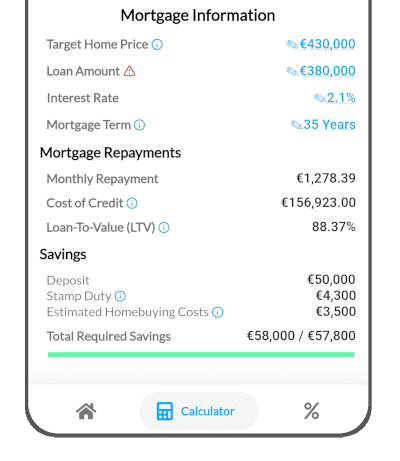

In the example above, a home valued at €430,000 bought with a €380,000 loan will require a deposit of €50,000. The buyer will also need savings to to pay €4,300 in Stamp Duty and have €3,500 to pay legal fees, surveyor costs etc. You will learn more about all of these as you progress through the homebuying process with Lively.

3. Ensure You Have a Clean Banking History

Lenders will validate that you are sensible with your money and that you don’t engage in activities that could impair your ability to repay your mortgage. This includes things like gambling large amounts or not paying into your savings account on a given month as you need money for a big occasion.

In the six months leading up to your mortgage application be sure that you’re consistently saving, paying your bills on time and avoid availing of your account’s overdraft. Note that your lender will also ask for bank statements for virtual bank accounts such as Revolut.

Some Exceptions Are Only Granted After Going Sale Agreed

As there are a limited amount of exceptions that can be given by a lender, often they don’t want to grant them to borrowers at the Approval in Principle stage of the application because this means locking up some of their exception quota for customers who may not actually use them that year. As such, some lenders require borrowers to be sale agreed on a home before granting an exception to have a stronger guarantee that the buyer will actually use it.

This situation puts buyers in an uncomfortable position where they need to bid on a property while relying on funds from an exception that they may not actually get. Therefore, it’s important to work with your lender/broker to understand the availability of exceptions at the time you are bidding on properties.

Lively is Making it Simpler To Buy A Home in Ireland

"Life Saver!"

★★★★★

Lively was created as a passion project to help buyers through the complicated and often overwhelming process of buying a home. Download our completely free app containing the best mortgage calculator out there, a step by step guide on how to buy a home in Ireland and live interest rates!