How Do Investments in Stocks and Cryptocurrencies Impact a Mortgage Application?

Sep 09, 2022

With online platforms making it easier than ever for individuals to invest their money, more and more people are trying their hand at speculating on stocks and cryptocurrencies. We explain how this may affect your mortgage application.

Investing in Stocks

How a lender views your stock investments will depend on how risky and sporadic your investments are. For example, someone who takes a percentage of their earnings every month and invests them in index funds or stable companies will likely be viewed favourably by lenders as this is money that could in theory also contribute to monthly mortgage repayments.

If you are investing sporadic sums of money chasing short-term gains or regularly trading “meme stocks” then lenders will consider it impulsive behaviour that may impact your ability to make mortgage repayments. The number one thing lenders want to see is consistency in the amount you will have available to contribute to mortgage repayments and you can demonstrate this with regular savings and rent payments.

Investing in Cryptocurrencies Like Bitcoin and Ethereum

Given the volatility of the cryptocurrency market since its inception, lenders naturally see investments in cryptocurrency as risky. Lenders have a variety of views on the asset class, with some considering it close to gambling while others see it as a speculative investment.

As long as you are consistent with your investments and still have regular savings, most lenders will not be concerned that you are investing in the cryptocurrency market. Monthly purchases may even be counted towards your "repayment capacity", i.e. the max amount you could in theory contribute to monthly mortgage repayments.

If you are only occasionally investing in cryptocurrencies make sure it's with your disposable income and that you don't dip into your regular monthly savings to try to make a quick profit. If you want to give yourself the best chance with every lender on the market it may be best to avoid purchases of cryptocurrency in the six months leading up to your mortgage application and put those funds directly into your savings for a guaranteed increase on your "repayment capacity".

Can Profits on Stocks and Cryptocurrencies Contribute to a Deposit?

Yes, any gains you have made can contribute to your deposit. Though of course you will need to sell the assets. Once the sale is complete you may need to provide evidence to your lender that you are in compliance with any tax owed on the sale of those assets, or have funds set aside for tax.

Be prepared to provide a paper trail from the time you deposited funds to an asset exchanges to the time any profits made it back to your bank account. Always consult a professional tax advisor if you are uncertain on your tax obligations.

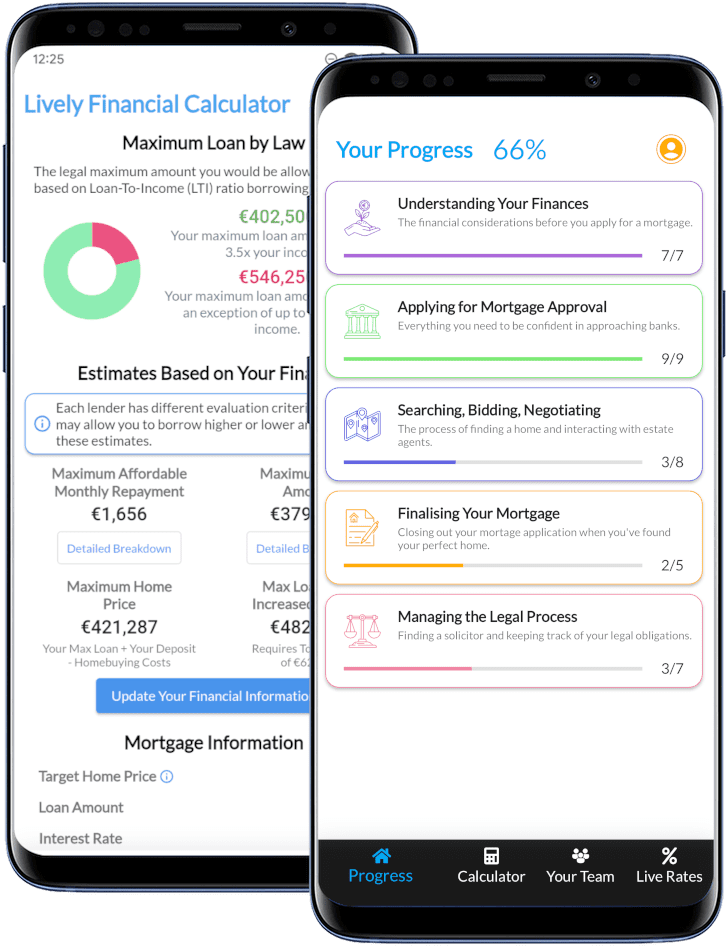

If you want to see how much you might be able to borrow, get an estimate on the most expensive home you can afford on sale of your portfolio, or calculate your monthly "repayment capacity" then try the Lively calculator!

Lively is Making it Simpler To Buy A Home in Ireland

"Life Saver!"

★★★★★

Lively was created as a passion project to help buyers through the complicated and often overwhelming process of buying a home. Download our completely free app containing the best mortgage calculator out there, a step by step guide on how to buy a home in Ireland and live interest rates!