Why Use a Mortgage Broker?

Save Thousands!

One of the many reasons people choose to work with our mortgage brokers is the potential for substantial savings. Mortgage brokers have access to a vast network of lenders and can help you find the most competitive rates and terms tailored to your personal financial situation. A broker can potentially save thousands over the life of your mortgage.

The following table illustrates the cost of credit on a €300,000 loan over the course of 30 years with different interest rates.

| Interest Rate | Monthly Repayment | Cost of Credit |

|---|---|---|

| 3% | €1,264.81 | €155,332.36 |

| 3.5% | €1,347.13 | €184,968.26 |

| 4% | €1,432.25 | €215,608.52 |

In this example, a rate difference of 1% means paying an additional €60,276 in interest over the course of the mortgage.

Get Mortgage Approval Faster

Time is of the essence when securing your dream home, especially when the market in Ireland is so competitive and interest rates are changing week by week. Mortgage brokers can expedite the approval process by navigating the paperwork, liaising with lenders, and ensuring your application is complete and accurate before you apply to cut down on the back and forth.

Mortgage Broker FAQ

How Much Do Brokers Cost?

All mortgage brokers earn commission from the lender when they secure you a mortgage, therefore many brokers are completely free! Some brokers do charge an up front fee for their work and those that do believe it allows them to provide a more personalised service to their customers as they don’t spend any time on people who aren’t serious about their application.

Is It Worth Getting a Mortgage Broker?

The value of a mortgage broker extends far beyond cost savings. Their in-depth knowledge of the mortgage market, access to a wide range of lenders, and ability to tailor solutions to your needs can make the process smoother and less stressful. If you're seeking a hassle-free, well-informed mortgage experience, the answer is a resounding "yes."

When Shouldn’t You Use a Mortgage Broker?

If you already have a good understanding of your finances, are up to speed on the intricacies of the mortgage application process and know which lender and rate you want to go with then hiring a mortgage broker may not be a good idea. Adding someone else in between you and the lender may actually slow the process down for you.

Can You Get a Mortgage Without a Broker?

Yes, it's possible to secure a mortgage without a broker. However, working with a broker can simplify the process, save you time, and potentially lead to better terms. Some lenders also only accept applications from mortgage brokers and will allow direct applications.

Which Lenders Do You Need a Mortgage Broker For?

It’s not always possible to apply to a lender yourself. The lenders that will only accept mortgage applications from brokers are:

- Haven

- Avant Money

- Finance Ireland

How Much Commission Do Mortgage Brokers Earn?

Typically mortgage brokers in Ireland will earn 1% of the mortgage amount from the lender. This means that if you take out a €200,000 mortgage then your broker will earn €2,000. The broker may also be subject to a ‘clawback’ on that commission whereby if you change mortgage provider in a short time period they are required to repay some of the commission they earned for securing your loan.

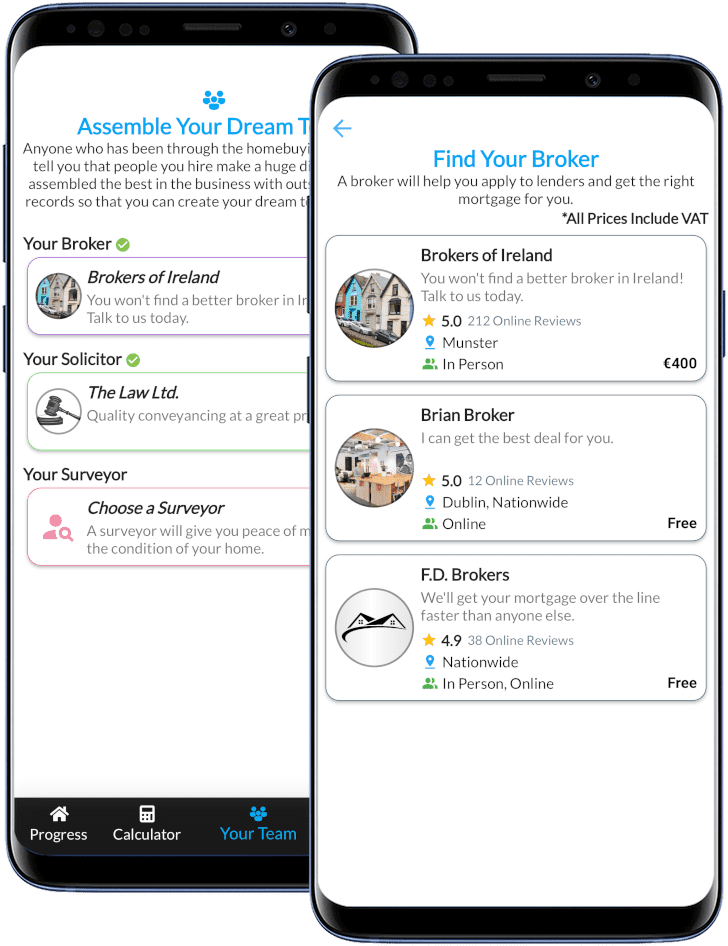

Do I Need to Meet My Broker in Person?

Meeting your mortgage broker in person is not necessary, as many brokers offer the flexibility of online communication. The mortgage process can be efficiently handled through various means, including phone calls, emails, and online meetings. However, you can choose a broker near you if you would prefer to meet your broker in person.

When Should I Contact a Mortgage Broker?

Ideally you should reach out to a broker any time from six months to the day you think you’re ready to apply for mortgage approval.

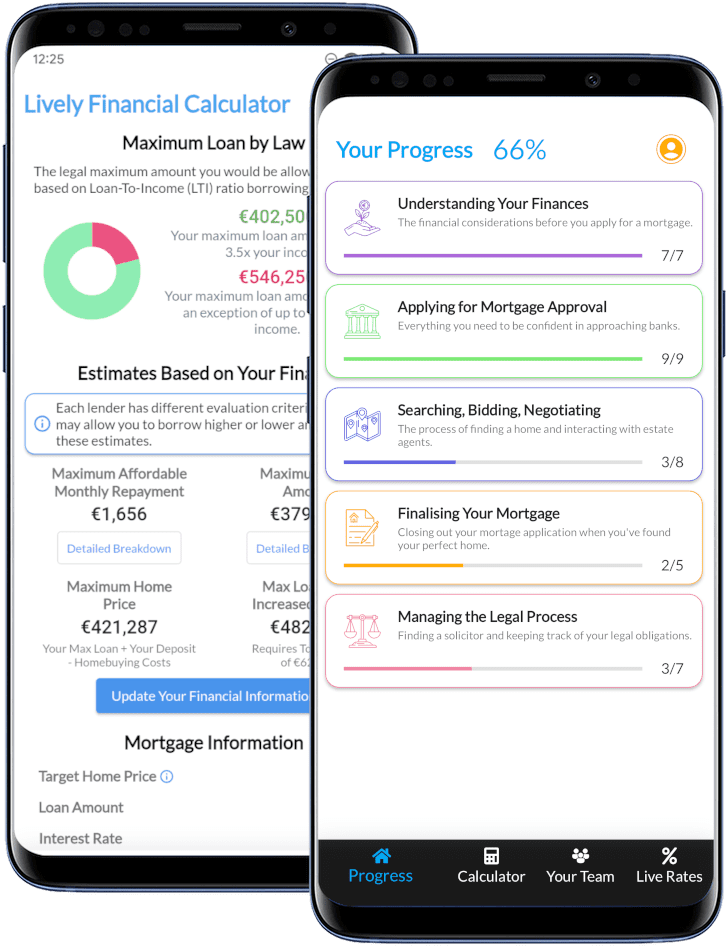

Lively is Making it Simpler To Buy A Home in Ireland

"Life Saver!"

★★★★★

Lively was created as a passion project to help buyers through the complicated and often overwhelming process of buying a home. Download our completely free app containing the best mortgage calculator out there, a step by step guide on how to buy a home in Ireland and live interest rates!