Ireland's Best Mortgage Calculator

Today's mortgage calculators ask you for some brief details about your finances followed by an unexplainable calculation or, worse yet, demand your contact information so a salesperson can get in touch.

We set out to build the best mortgage calculator on the planet to show you how a lender might look at your finances and help you answer these questions:

- How much can you borrow?

- Could you be eligible for an exception/exemption?

- How much will your mortgage repayments be?

- How much will stamp duty cost?

- What will your legal costs be?

- How much interest will you pay?

- What savings will you need to buy a home?

Download Lively to get started. It's 100% free!

Choose Your Device

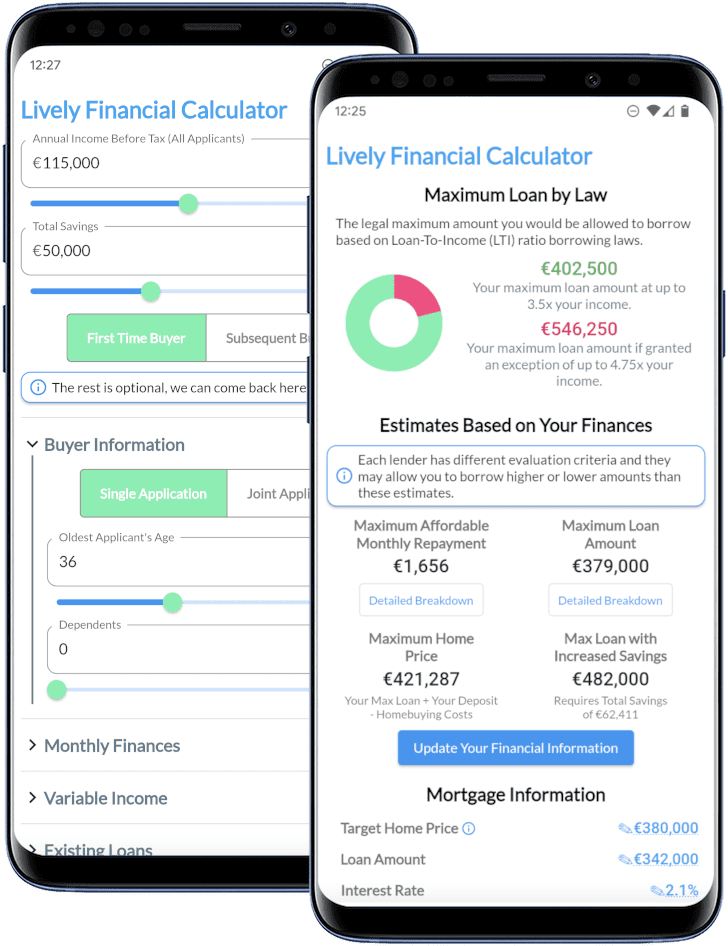

How Much Can You Borrow?

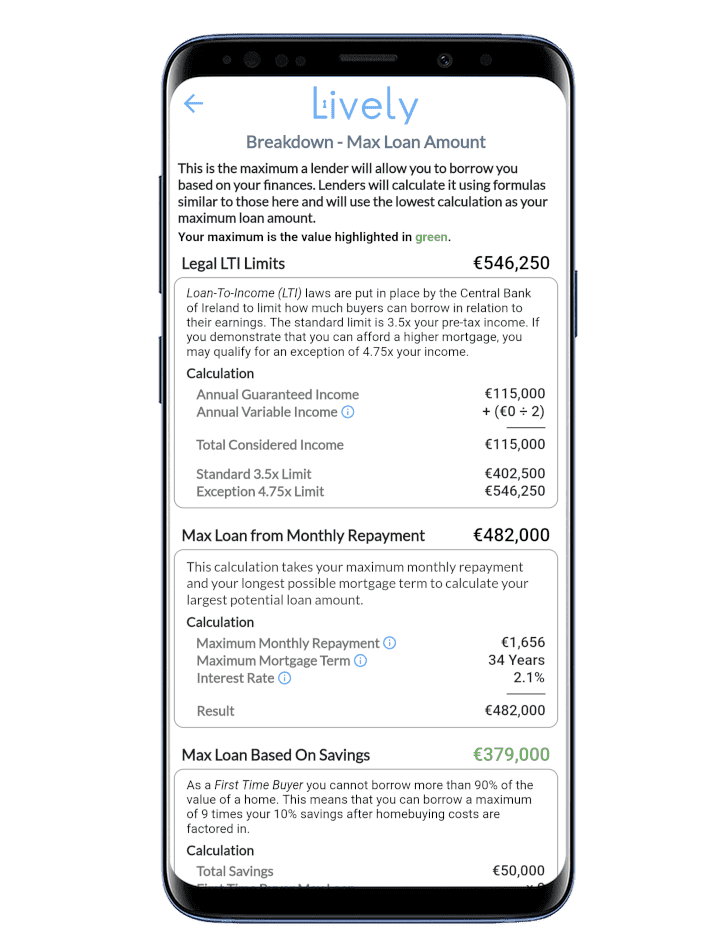

Loan-To-Income (LTI)

Legally you can borrow up to 4x your pre-tax income as a First Time Buyer or 3.5x as a Subsequent Buyer. However if you can comfortably prove you can make the monthly repayments you will be able to apply for an “exception” to the borrowing limits in order to take out a loan of up to 4.75x your income.

Current Savings

Your deposit will limit the amount you can borrow. As a first time buyer you can borrow a maximum of 90% of the price of a home. As a subsequent buyer that figure is reduced to 80%. Your savings will also be needed to pay for additional costs of purchasing a home such as legal costs and Stamp Duty.

Max Monthly Repayment

Naturally a lender will want you to be able to prove you can make the monthly repayments for your mortgage so the maximum monthly repayment you can afford will place an upper limit on your loan amount.

Your Maximum Monthly Repayment

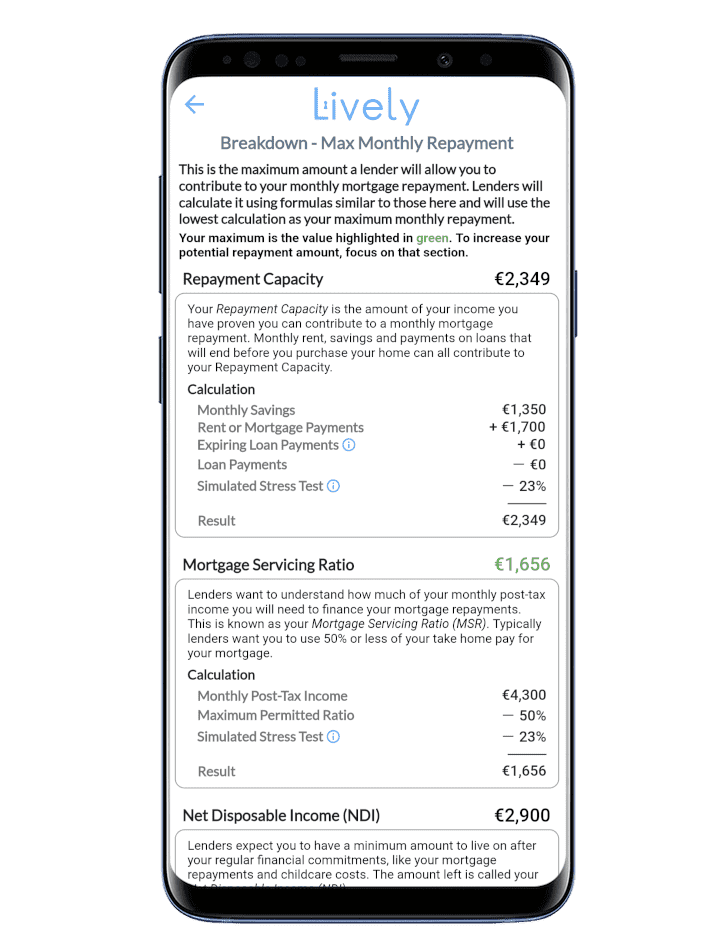

Calculating your maximum potential mortgage repayment is deceptively challenging as there are many criteria lenders inspect.

Repayment Capacity

Your Repayment Capacity is the amount of your income you have proven you can contribute to a monthly mortgage repayment. Monthly rent, savings and payments on loans that will end before you purchase your home can all contribute to your Repayment Capacity.

Mortgage Servicing Ratio

Lenders want to understand how much of your monthly post-tax income you will need to finance your mortgage repayments. This is known as your Mortgage Servicing Ratio (MSR). Typically lenders want you to use 50% or less of your take home pay for your mortgage.

Net Disposable Income (NDI)

Lenders expect you to have a minimum amount to live on after your regular financial commitments, like your mortgage repayments and childcare costs. The amount left is called your Net Disposable Income (NDI).

Stress Test

Lenders will ‘Stress Test’ your maximum monthly repayment to ensure you can meet your mortgage repayments in the case of interest rate increases. They will want to ensure you can handle a 2% increase in interest rates which will decrease your maximum monthly repayment amount by around 23%.

Repayments Calculator

Calculating your maximum potential mortgage repayment is deceptively challenging as there are many criteria lenders inspect.

1. Loan Amount

Naturally the amount you borrow will be the primary contributor to how much your monthly repayments will be.

2. Interest Rate

The interest rate is the amount of interest you will owe the bank on the outstanding value of your loan every year. When choosing a lender a 0.5% or 1% may not seem like much but the difference can mean tens of thousands of Euro in additional interest paid over the course of the mortgage.

3. Term Length

Your mortgage term is the number of years over which you’ll repay the mortgage. Typically lenders will allow a mortgage term of up to 35 years. Paying off your mortgage over a longer period of time will mean smaller monthly repayments but it also means you will pay more in interest to your lender.