Compare the Best Surveyors in Ireland

Trusted by over 10,000 homebuyers! 🎉

Whether it’s Cork, Dublin, Galway, Donegal or anywhere in between we have the best surveyor for you.

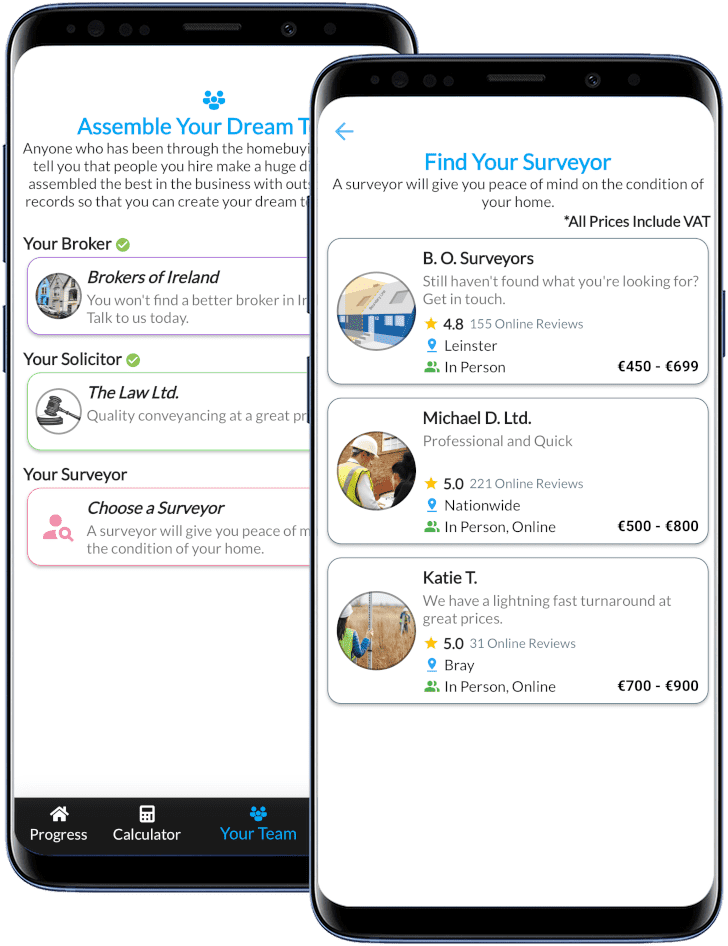

Compare Property Surveyors and Snaggers With Lively

- Compare Snag List and Pre-Purchase Survey Prices

- Read Hundreds of Customer Reviews

- Fast Turnaround Times

Download Lively To Book Your Snag or Survey!

Why Choose A Surveyor With Lively?

Know You're Making The Right Decision Before Moving In

Purchasing a home will be the single biggest purchase of your life. That’s why it’s so important to hire a quality surveyor who can give you the confidence that your home is in great condition before signing on the dotted line, or help you understand your options if it isn’t!

No Surprises - Up Front Pricing

Say goodbye to surprises! Lively ensures you receive up-front pricing information so that you know exactly what you're bill will be and allowing you to compare costs across the industry.

Hundreds of Surveyor Reviews

Don’t just take our word for it! Compare hundreds of reviews for different surveyors to find the right person to carry out your pre-purchase survey or snag report.

Frequently Asked Questions About Surveyors

What's The Difference Between a Pre-Purchase Survey and a Snag List?

A Pre-Purchase Survey is a report that will be made if you are purchasing a second hand home. A pre-purchase report is a detailed inspection of the interior and exterior of your home that identifies any potential problems and defects with the property.

A Snag List Report is a report you will get if you are purchasing a new home. A snag list is a report that identifies any poor construction work, inadequate finishes or any breaches of construction health and safety law.

What Does a Pre-Purchase Survey Contain?

A pre-purchase survey will contain a report on any defects in a property. If there are also any additions to the property, like an extension or an attic conversion, a surveyor will be able to help determine if the new construction work is up to standard. A pre-purchase report will come with recommended steps to remediate any problems. Your report will highlight common issues like:

- Dampness.

- Cracks.

- Poorly Insulated Areas.

Can You Renegotiate a Home Price Based on Findings From a Survey?

Under certain circumstances it’s acceptable to renegotiate a home sale price after a survey report is produced. You should expect any second hand home to have issues that require addressing and renegotiating price over minor details is quite uncommon. Where you might consider trying to reduce the sale price is if there are serious issues uncovered that were not apparent when bidding on the property. Keep in mind if you do start to renegotiate the seller may also consider going back to the market to find a new purchaser.

When Should You Conduct a Pre-Purchase Survey?

Generally you should co right after you are Sale Agreed, however there are some circumstances you may want to conduct a survey before placing a bid such as when bidding on a derelict property and your bid amount depends on the content of the survey.

Why Should You Get a Snag List Report?

Don’t assume that just because you're buying a new home that it will be perfect when the developer hands it over, most new homes have some issues that require addressing! You should hire a snagger to produce a snag report during the time period when your developer allows you to review the property condition near completion. You can then use the report to request that any identified issues be fixed. This will save you a significant amount of time and money over fixing problems yourself after you move in.

What Does a Snag List Report Contain?

A snag list will contain an itemised report of any issues identified by the snagger, frequently alongside images of those issues. Issues contained in the report can be anything from paint scratches and unfinished surfaces to more serious defects like cracks in the walls or ceilings.

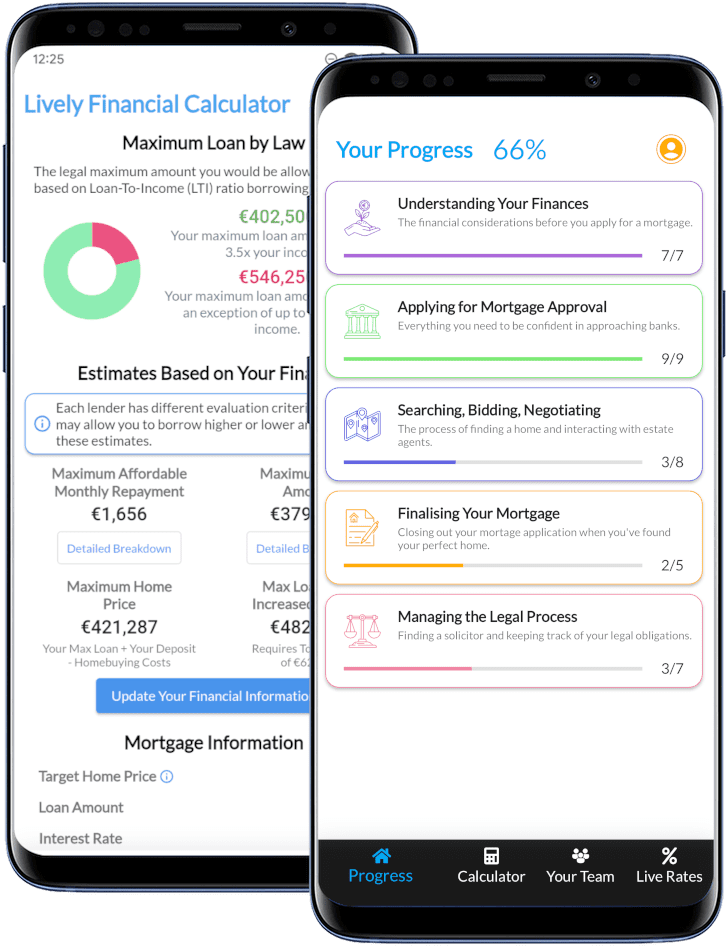

Lively is Making it Simpler To Buy A Home in Ireland

"Life Saver!"

★★★★★

Lively was created as a passion project to help buyers through the complicated and often overwhelming process of buying a home. Download our completely free app containing the best mortgage calculator out there, a step by step guide on how to buy a home in Ireland and live interest rates!