Get Approval in Principle

Once you have your documents ready, it's time to start reaching out to lenders! You can call or email banks directly to kick off the process, they will be happy to hear from you.

Approval in Principle

When you submit your initial financial information to a lender, they will grant you Approval in Principle (AIP). Approval in principle is an estimate of how much a lender may grant you if your financial circumstances don't change. When finalising your mortgage, they will carry out more thorough checks and the amount you can borrow may ultimately be different. You should apply for the maximum amount you can even if you don't intend to use it, you can lower the amount when you find a home.

It's a good idea to get approval in principle from more than one lender in case there is delays with a lender or they withdraw their offer when you are closing the mortgage application. If a mortgage application falls through after you are sale agreed on a property, having another lender on standby may prevent you from missing out on a home.

The approval is generally valid for 6 months. Many estate agents will request a copy of your approval in principle when you bid on a property, though you can redact the exact values to hide your highest potential offer.

Don't Change Your Financial Circumstances

When you are approved in principle for a mortgage it is based on your financial circumstances at the time. When you finally purchase a home the bank will verify your financial health again. This means that before you have purchased a home you should try to avoid doing anything that would would cause the lender to lower the amount you are approved for.

Here are some examples of changes you should avoid:

- Changing Jobs - If you change jobs you will need to wait until your probation period passes again before a lender will approve your mortgage.

- Reducing Monthly Savings - Your lender will look at your recent bank statements again to make sure you are still capable of paying a mortgage.

- Taking Out a Loan - Loans such as car loans will be seen as a lender as a risk to your repayment capacity.

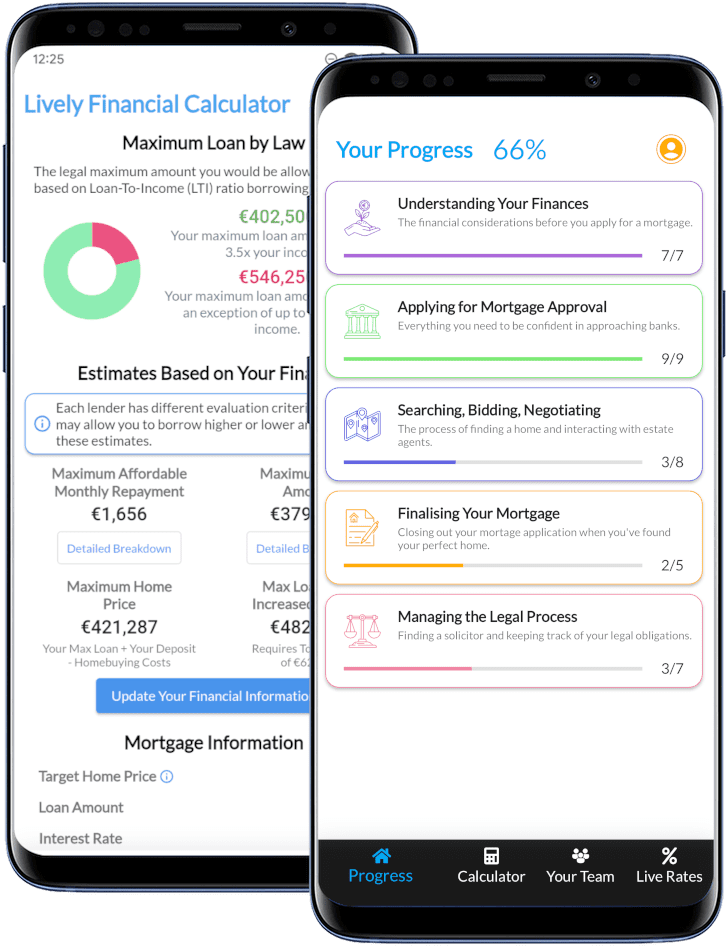

Lively is Making it Simpler To Buy A Home in Ireland

"Life Saver!"

★★★★★

This page describes one of many steps towards buying a home. Want to keep track of your home buying journey? Download our completely free app! It contains live interest rates and a step by step guide on how to buy a home in Ireland, from applying for mortgage approval to getting your keys.