Prepare Bank Statements

Your lender will request bank statements for the previous six months. Not only will you need bank statements from your primary bank account, but you will likely need to submit records for other bank accounts you may have such as Revolut. Your lender may follow up with questions on large transactions in your statements.

What are lenders looking for in my transaction history?

Lenders review your bank statements to ensure you are responsible with your money, that you are saving regularly and are able to meet your financial obligations on time without frequently availing of overdrafts. They will also verify that you have not misled them with details of your application. One example of this is payments for a loan that you have not disclosed.

In the case of a single individual applying for a mortgage, they will verify that there aren't a significant amount of transactions to a potential partner that would imply shared financial responsibilities or that your partner is dependant on your income. If this is the case, you will need to declare it to any potential lenders so that they can factor it into your application.

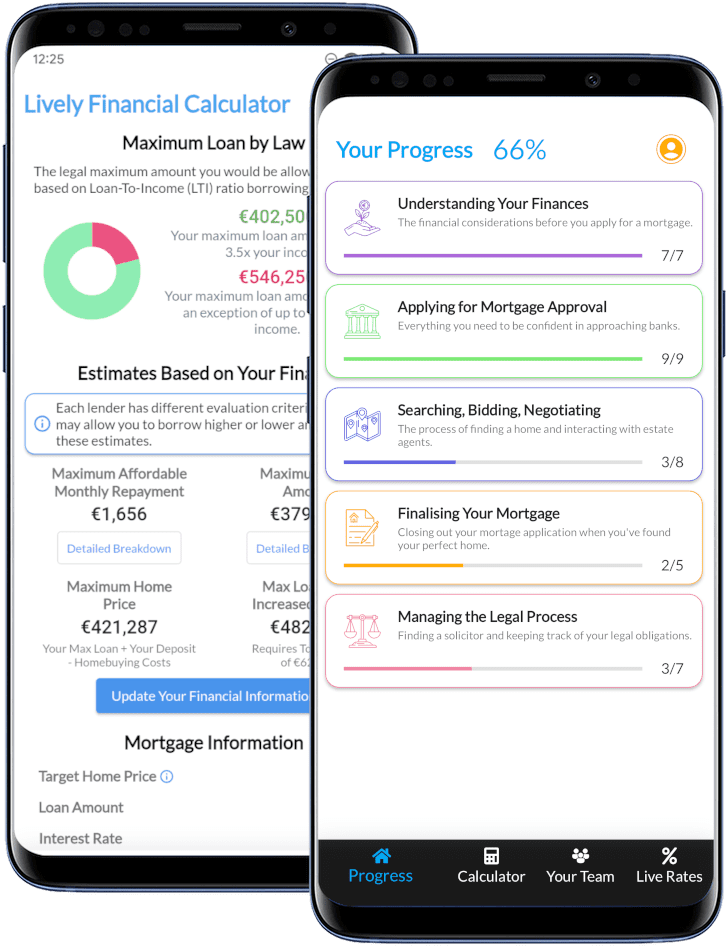

Lively is Making it Simpler To Buy A Home in Ireland

"Life Saver!"

★★★★★

This page describes one of many steps towards buying a home. Want to keep track of your home buying journey? Download our completely free app! It contains live interest rates and a step by step guide on how to buy a home in Ireland, from applying for mortgage approval to getting your keys.