Decide on Fixed or Variable Rate

A fixed rate mortgage means you will accumulate interest due on your loan at a fixed rate for a number of years, usually anywhere between 3 and 7 years. This means that your monthly repayments will remain the same for the length of your fixed term contract.

A variable rate means your interest rate is influenced by economic conditions and is subject to change at the discretion of the bank.

Here are some of the key considerations when making your decision:

- Fixed rate mortgages provide more stability and peace of mind. You won't need to worry about interest rates until your fixed term expires.

- Typically on fixed rate mortgages, you will not be able to pay back lump sums of your loan without incurring a fee. With variable rate loans, you are free to repay lump sums or overpay on a monthly basis at your leisure. This flexibility allows you to reduce your monthly payments or shorten your mortgage length over time.

- Fixed rate loans allow you to lock in a lower interest rate in a market where interest rates are likely to rise. Likewise, variable rate loans allow you to take advantage of lower interest when interest rates are falling.

How does the interest rate impact my repayments?

When deciding on a lender, the interest rate offered should be your main consideration. The total interest paid on your loan is known as the Cost of Credit. Small changes to your yearly interest rate can have a significant impact on your cost of credit over a long period of time.

The following table illustrates the cost of credit on a €300,000 loan over the course of 30 years with different interest rates.

| Interest Rate | Monthly Repayment | Cost of Credit |

|---|---|---|

| 3% | €1,264.81 | €155,332.36 |

| 3.5% | €1,347.13 | €184,968.26 |

| 4% | €1,432.25 | €215,608.52 |

In this example, a rate difference of 1% means paying an additional €60,276 in interest over the course of the mortgage.

What happens when my fixed rate period ends?

When your fixed period ends, you are free to reevaluate the market and sign a new fixed or variable rate contract. You can even move your mortgage to a different bank. If you have been saving during your fixed rate, you can pay off a lump sum without incurring fees and then begin a new fixed term contract.

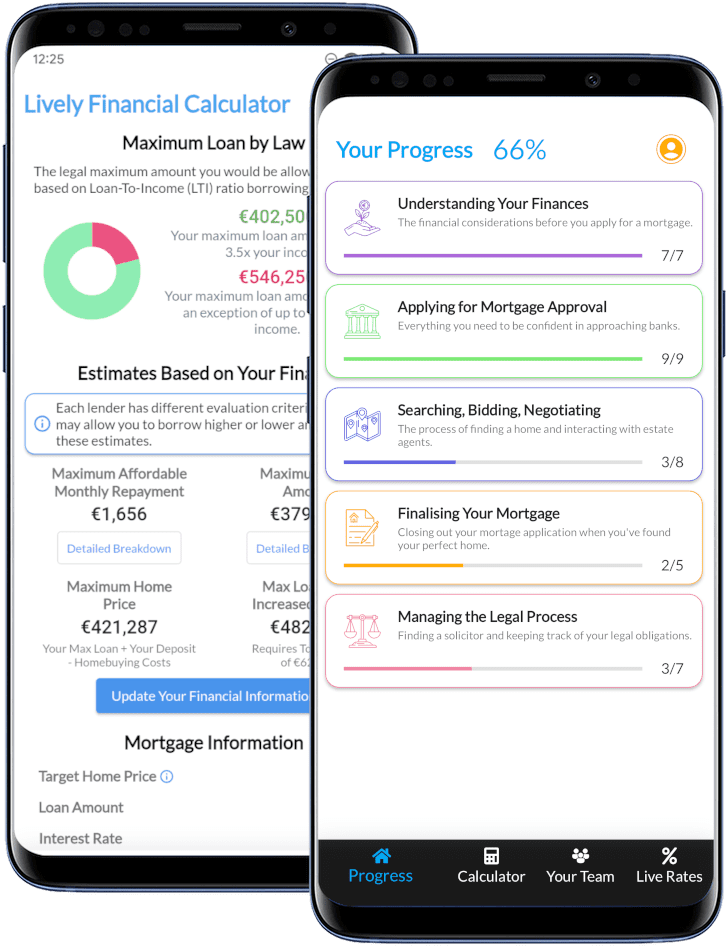

Lively is Making it Simpler To Buy A Home in Ireland

"Life Saver!"

★★★★★

This page describes one of many steps towards buying a home. Want to keep track of your home buying journey? Download our completely free app! It contains live interest rates and a step by step guide on how to buy a home in Ireland, from applying for mortgage approval to getting your keys.