Optional: Consider Borrowing for Renovations

While more difficult, if you’re planning on buying a fixer-upper you can apply for a mortgage that includes the cost of renovation. For example if you qualify for a mortgage of €300,000 you could put €200,000 towards the sale price and borrow €100,000 for construction. You’ll need to prove that the cost of the renovation increases the value of the home by at least the same amount.

Applying for a Mortgage Including Renovations

You’ll need to get a quote from a builder, architect or surveyor on the cost of renovations for the property you have in mind. With that you will ask the bank’s valuer to produce two valuations. The first is the value of the property currently and the second is an estimate of the value after the proposed work is finished. Your lender will also likely ask you to add a 10% buffer to the price of renovations to account for any unforeseen costs.

Accessing the Renovation Fund

One challenge with this approach is that your lender won't give you the full renovation amount right away. They will gradually release funds as sections of work are completed. This means you will need to fund sections of the work up front and have additional cash put aside when applying for your loan.

Lively is Making it Simpler To Buy A Home in Ireland

"Life Saver!"

★★★★★

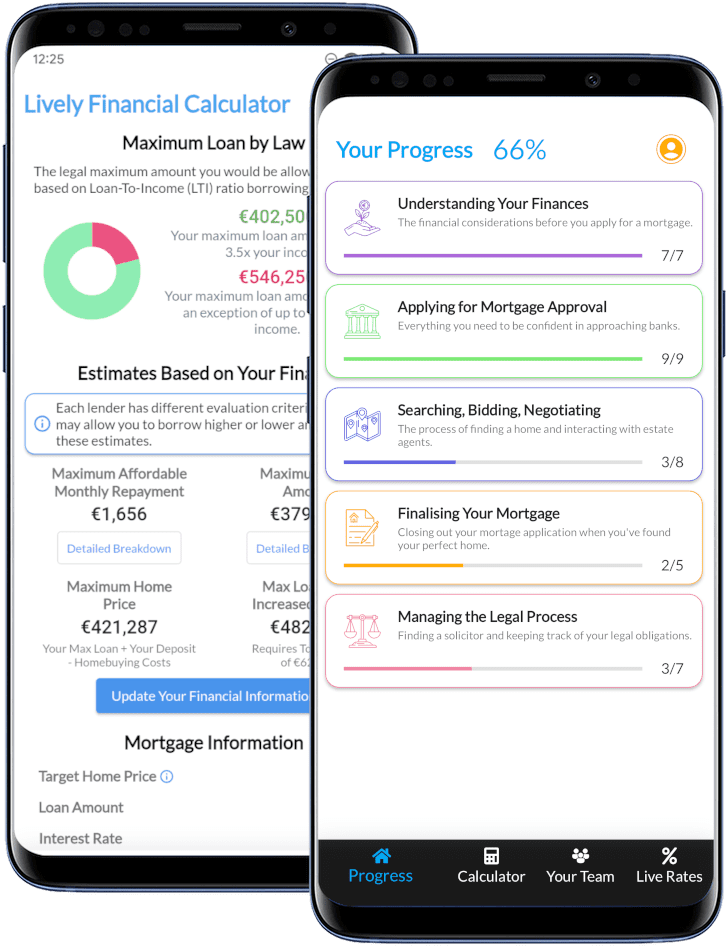

This page describes one of many steps towards buying a home. Want to keep track of your home buying journey? Download our completely free app! It contains live interest rates and a step by step guide on how to buy a home in Ireland, from applying for mortgage approval to getting your keys.