Evaluate Local Property Tax

Your solicitor will verify that there are no outstanding taxes due on the property. One such tax is Local Property Tax (LPT). LPT is paid to your local council yearly based on the valuation of your home.

Who is liable to pay LPT in the event of a sale?

The owner of the property on November 1st of a given year is responsible for the payment for the following year. So if you own a home on November 1st 2021 you are responsible for paying the tax for 2022, however, when a home is sold it is typical for the buyer to repay the seller for the period they will own the home.

What if my home is a new build?

New homes will need to be registered for LPT every November starting in 2021.

What if I believe the valuation is incorrect?

After the sale of the property, you can write to your local LPT branch to update the property valuation.

How much is LPT?

The amount paid is based on the property's value. The last time values were set was in November 2021 and the government asks owners to submit new estimates on their home value every 4 years.

It varies slightly for each local council in Ireland. For the Dublin City Council region, a home valued at €375,000 would pay €573 in property tax and a home valued at €675,000 pays €1,032.

You can find out how much you will owe using the revenue.ie LPT calculator.

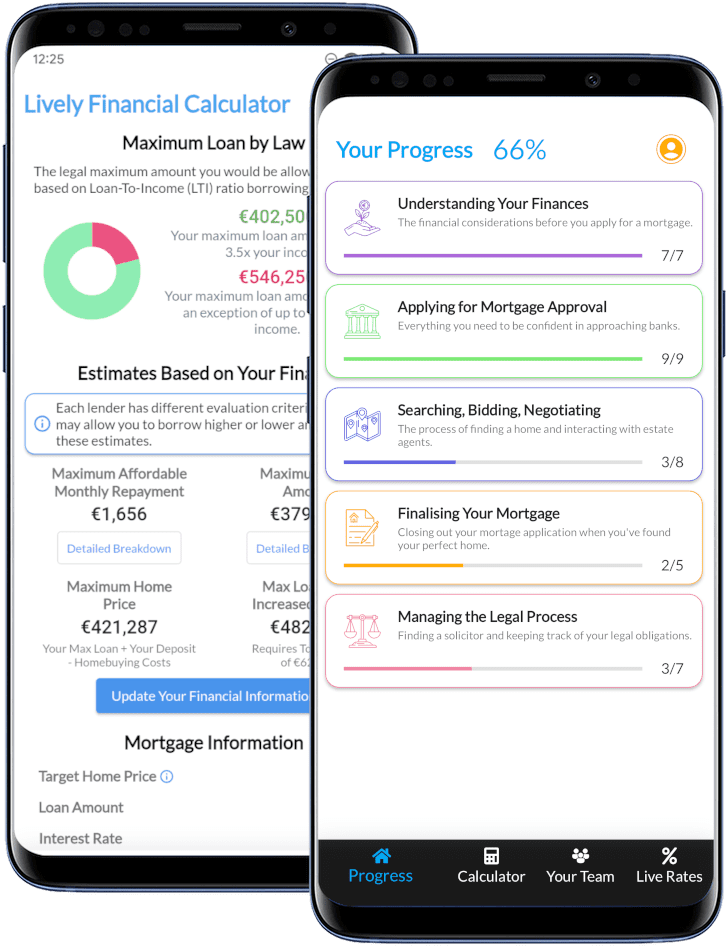

Lively is Making it Simpler To Buy A Home in Ireland

"Life Saver!"

★★★★★

This page describes one of many steps towards buying a home. Want to keep track of your home buying journey? Download our completely free app! It contains live interest rates and a step by step guide on how to buy a home in Ireland, from applying for mortgage approval to getting your keys.