Sign the Contracts

Your solicitor will let you know when it's time to sign the contracts. They will go through the terms and conditions to make sure that you are happy with them.

Once you sign the contracts, you are legally obliged to purchase the property and the seller is obliged to sell it. If you pull out of the sale after this point, you may lose your deposit.

Your solicitor will determine a closing date with the seller, at which point you will own the property as long as the seller has received full payment.

Subject To Loan Clause

A Subject to Loan clause is a clause in the contract stating that you can legally pull out of a sale and reclaim your deposit if you are unable to finalise your mortgage with a lender. This can happen in situations such as when interest rates rise and increase your potential monthly repayment to an amount you could no longer afford, in which case a lender wouldn't approve the loan. Although most solicitors will include this clause, talk to your solicitor to ensure you are protected.

Include Appliances and Fixtures in the Contract

When buying a second hand home it's not always clear to the buyer what is included in sale other than the physical building. Items like appliances, light fittings and wall fixtures are all up for negotiation. Any agreements here should be in the contract as you can't rely on a verbal agreement to be sure these will be left in the home when you get the keys. For particularly expensive appliances you might even consider noting the model in the contract to ensure the seller doesn't replace them with cheaper versions before they leave.

Be sure to include a clause in the contract that anything not included in the sale needs to be removed by the seller, otherwise you may end up with a bunch of abandoned rubbish you'll need to dispose of.

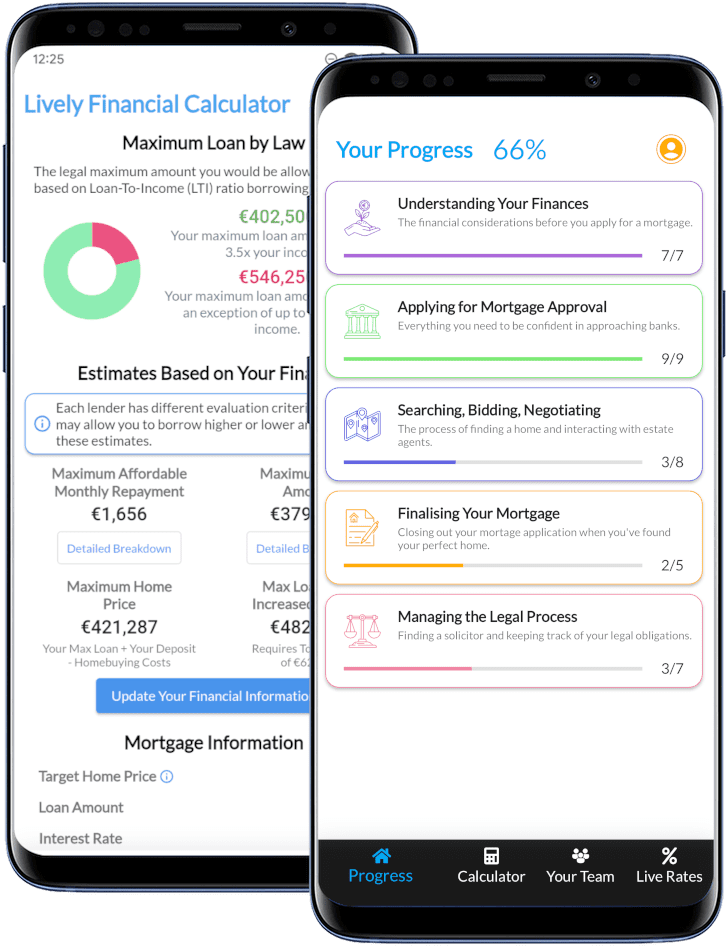

Lively is Making it Simpler To Buy A Home in Ireland

"Life Saver!"

★★★★★

This page describes one of many steps towards buying a home. Want to keep track of your home buying journey? Download our completely free app! It contains live interest rates and a step by step guide on how to buy a home in Ireland, from applying for mortgage approval to getting your keys.